If you’ve arrived on this page, the question on your mind is probably “do I need private hospital cover in a country with a mostly-decent public health system?”

It’s likely you have family or friends who say hospital cover isn’t necessary, because the public health system takes care of urgent and acute surgery and treatment. But you’ll also know people who say private health insurance is essential, because the waiting lists for non-urgent surgery are really long.

Below we explain more about major medical cover and why you might want it. We also look at how much it could cost, what is usually excluded and how you go about getting cover.

What is major medical health cover?

Major medical health cover goes by several descriptors in New Zealand. In addition to ‘major medical’, it’s sometimes called ‘surgical cover’ or ‘hospital cover’. All of them accurately describe health insurance that’s focused on procedures in a private hospital. Some policies also extend their cover to specialist consultations, high-cost diagnostic scans and tests, and drugs that PHARMAC doesn’t fund.

Every health insurer offers their own variety of surgical or major medical cover, but generally the idea is that you’re covered for non-acute (elective) surgery or treatment. Instead of going on a DHB waiting list, you get your procedure done quickly and efficiently in a private hospital.

To understand the value of major medical cover, it helps to know about the most commonly claimed procedures in New Zealand. Here’s the list from NZ’s largest health insurance provider:

- Hip replacement

- Chemotherapy

- Knee replacement

- Spinal fusion surgery

- Colonoscopy

- Skin lesion removal

- Hysterectomy

- Endometriosis surgery

- MRI scan

- Cataract surgery

- Tonsillectomy

- Inguinal hernia repair

- Adenoidectomy

- Coronary angioplasty with stents

- Surgical removal of teeth

- Bilateral ear procedure

Why get major medical health cover?

Compared to many other nations, New Zealand is lucky. We have a free public health system that takes care of acute (emergency or life-threatening) medical needs. We also have an accident insurance scheme (ACC) that covers medical expenses for accident-related injuries.

However, if you need medical or surgical intervention that’s not urgent or injury-related, you’ll probably go on a waiting list. Four months is the timeframe DHBs aim for, but real-life wait times are often much longer. While you’re waiting, you could be in pain and your lifestyle could be severely affected. You might also find it difficult to work.

Having major medical cover provides you with access to New Zealand’s private hospitals for surgery and treatment. This ensures you can have prompt procedures for a wide range of conditions that don’t qualify for immediate treatment in the public system.

If you’re thinking about getting major medical cover, here are the questions to ask yourself:

- Am I willing to endure months (or even years) of waiting for treatment for a serious medical condition?

- Could I financially sustain partial or complete absence from work during an extended waiting period?

- Would I be able to cover the cost of private treatment at a moment’s notice from my own savings?

- Would I prefer to choose my own specialist and hospital in the event of a serious medical condition?

- Am I currently free of major health issues (pre-existing conditions)?

What’s in a basic major medical plan?

Most health insurers offer basic major medical cover that includes:

- General surgery: Covers the costs associated with having a surgical procedure, including private hospital costs, surgeon fees and anaesthetist fees. This cover usually extends to specialist consultations and tests that are related to the surgery.

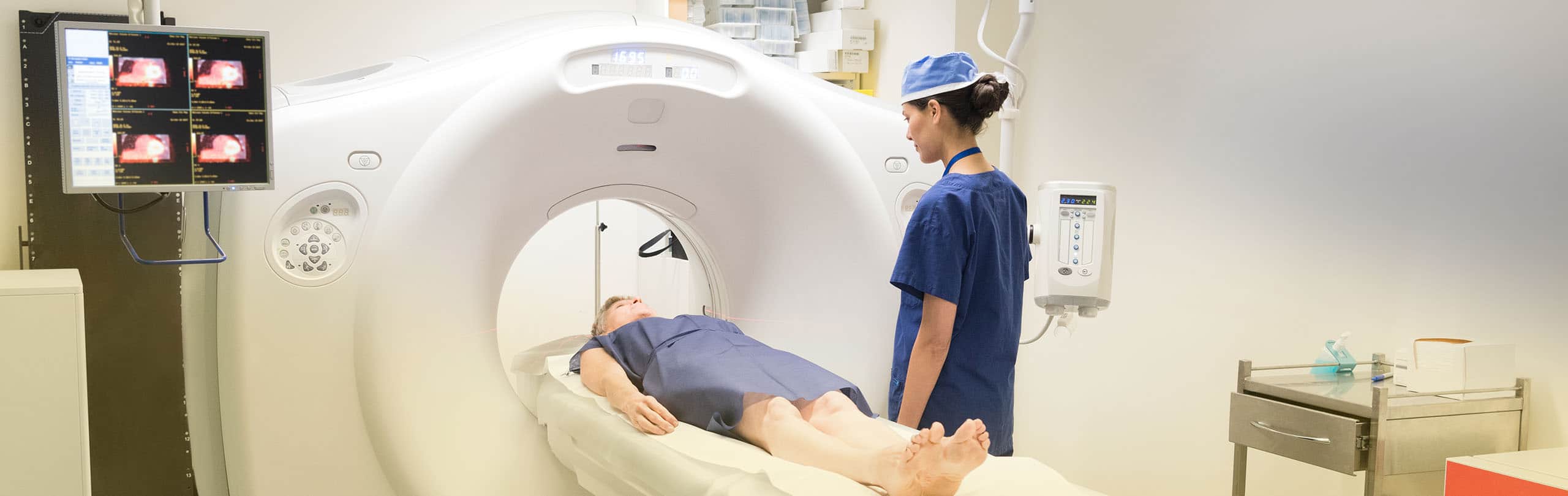

- Diagnostic procedures: Covers the costs for major diagnostic procedures that are directly connected to having surgery, such as angiograms, MRI scans, CT scans and endoscopies.

- Oral surgery: Covers the cost of oral surgery, such as the removal of impacted teeth, abscesses, cysts, soft tissue swellings and other medical (not dental) mouth issues.

- Private hospital medical: Covers the costs associated with admission to a private hospital for non-surgical treatments, including chemotherapy and radiation therapy.

- Non-funded drugs: Covers the cost of drugs that aren’t funded by PHARMAC, when used in the context of general surgery or private hospital medical admission.

What’s in a deluxe major medical plan?

If you want the maximum amount of financial protection from your major medical plan, you can get various add-ons and upgrades. Here are some examples:

- Specialist cover that’s not connected to surgery

- Diagnostic procedures that aren’t connected to surgery

- Dental and optical treatment

What does major medical cover cost?

Premiums for major medical cover are determined by your age, gender and lifestyle habits. This means we can’t give you anything more than a ballpark price for cover. Here’s a broad cost indication:

| Individual - non-smoker | Basic (monthly) | Premium (monthly) |

|---|---|---|

| 25-year-old | $60 | $100 |

| 35-year-old | $70 | $120 |

| 45-year-old | $100 | $160 |

| 55-year-old | $150 | $240 |

One way to make health cover cheaper is agreeing to an excess. This means you’ll pay an agreed amount (e.g. $500, $1,000, $2,000 or $4,000) towards the procedure or treatment you need.

As you grow older, health insurance premiums tend to go up. When you need health insurance the most, during retirement, it can become a major expense. However, you need to balance this high cost against the risk of decreased quality of life.

What will the health insurer want to know?

When you’re applying for major medical cover, it’s important to keep in mind that your insurer will want to know all about your health history and any lifestyle factors that might impact your health future. They’ll be particularly interested in any ‘pre-existing conditions’ you may have.

Pre-existing conditions generally refer to any known conditions, signs or symptoms. These could include minor ailments (like a sore shoulder or knee) that were discussed with your GP, but not diagnosed as medical conditions. Typically, health insurance companies don’t provide major medical coverage for pre-existing conditions.

It’s crucial to provide accurate and complete health information when applying for health insurance. Non-disclosure is a common reason for insurance claims being declined. To ensure you don’t accidentally forget to mention something, you can access your medical records through your regular doctor. There may be a charge involved, so it’s a good idea to inquire about the cost beforehand.

Can you get primary care health cover for your family?

Do you have access to primary care health cover through a group scheme?

Next steps for getting primary care health cover.

There are several private health insurance providers in New Zealand offering major medical cover. They include Southern Cross, Accuro, AIA, UniMed, NIB, HealthCarePlus and Partners Life. When you’re comparing policies and options, always read the fine print and ask questions. It will be helpful to enlist the help of an insurance broker or financial adviser, especially if they work with several health insurance providers.

Read our guide to primary care health cover